how much does the uk raise in taxes

UK tax revenues were equivalent to 33 of GDP in 2019. But that is.

Uk Spring Statement Updates From March 23 Sunak Cuts Fuel Duty And Promises Lower Income Tax Financial Times

During the 1990s fuel duty increased rapidly.

. The main rate of corporation tax will increase from 19 to 25 as of April 2023 and companies that earn less than GBP 50000 per year will see their small profits rate increase from 19 to 19. Figure 1 shows that tax as a share of national income has fluctuated between around 30 and 35 of national income since. The government says the changes are expected to raise 12bn a year.

During 201920 the government plans to spend 8 billion. In line with inflation there will be an increase in allowances and the basic rate limit. How much would a land value tax raise UK.

Tax revenue raised by SDIL is expected to reach about 530m per year all of which is aimed at tackling the obesity crisis on school campuses ning its plans for the SDIL in 2016 it estimated that the tax would raise about 530m per year all of which At the end of the current fiscal year just 33m had been claimed by the levy. Johnson had promised to. In 202122 the value of HMRC tax receipts for the United Kingdom amounted to approximately 71822 billion British pounds.

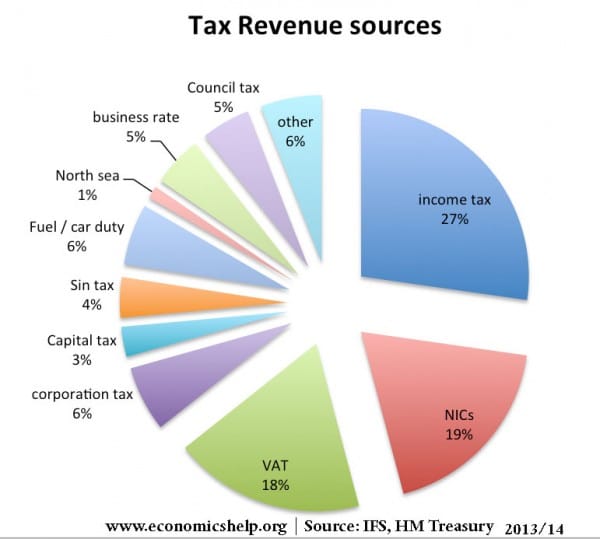

The dividend ordinary rate will be set at 875. Of tax revenue between the UK and Scandinavia is income tax the UK government gets 91 of national income in income tax compared with an average of 160 in Denmark Norway and Sweden. Allocate the oil on a population basis 83 rather than 842 and Scotlands tax receipts for 201213 were 481bn rather than 531bn equivalent to.

How much is fuel tax. In 2019-20 VAT raised 134 billion this measure of VAT excludes refunds of VAT made to certain public sector organisations. The poorest 10 pay 4000 in tax mostly indirect VAT excise duty.

That would be an extra 91000 in tax revenue per person. They receive around 2000 in benefits. From 229 in total income taxes it is anticipated that receipts will increase.

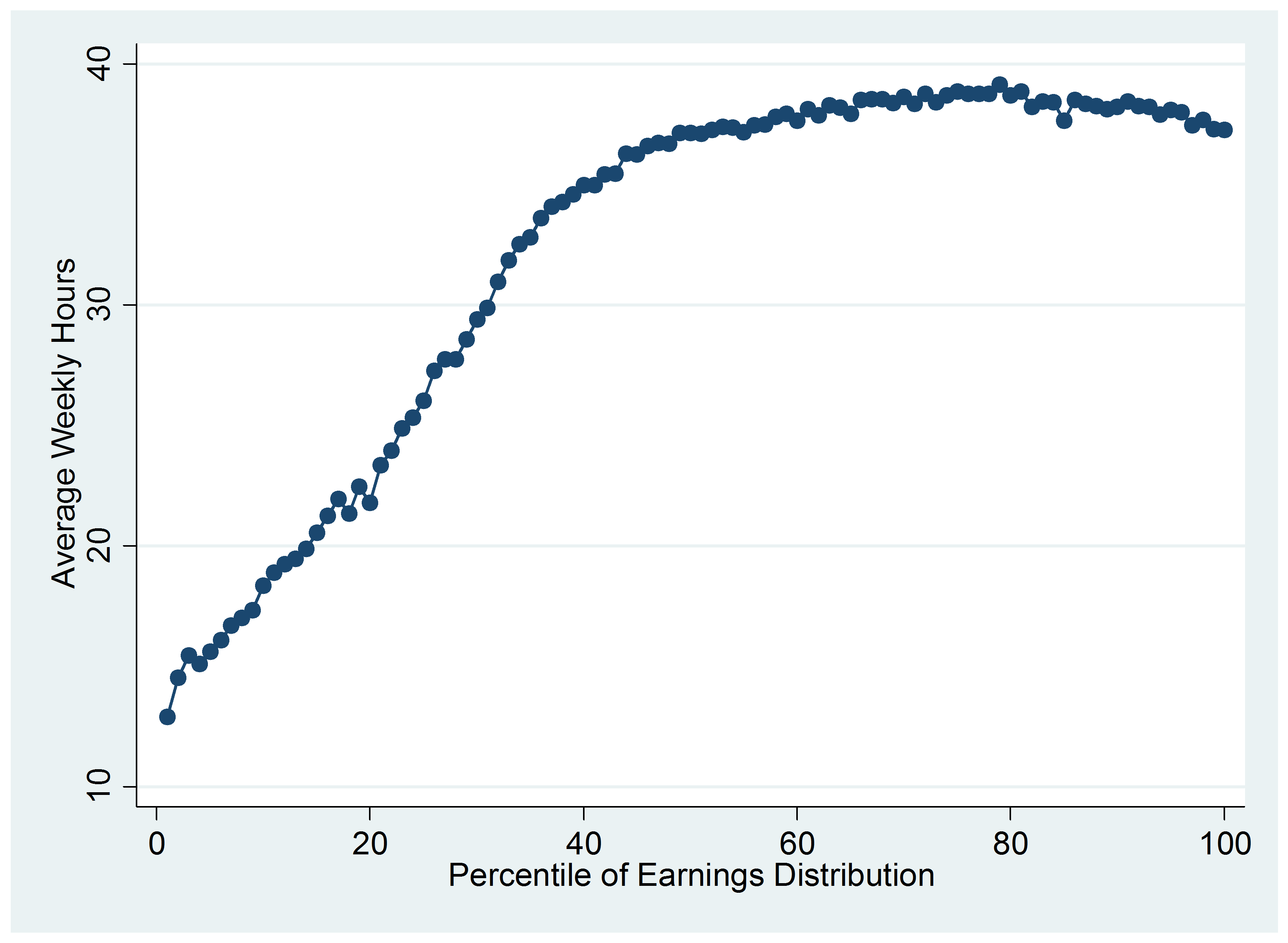

The richest 10 pay over 30000 in tax mostly direct income tax. Taxes as defined in the National Accounts are forecast to raise 6229 billion equivalent to roughly 11800 for every adult in the UK or 9600 per person. What is the tax increase for.

Increasing the point at which people start paying it will cost more than half. This measure increases the rates of Income Tax applicable to dividend income by 125. Much of the revenue initially.

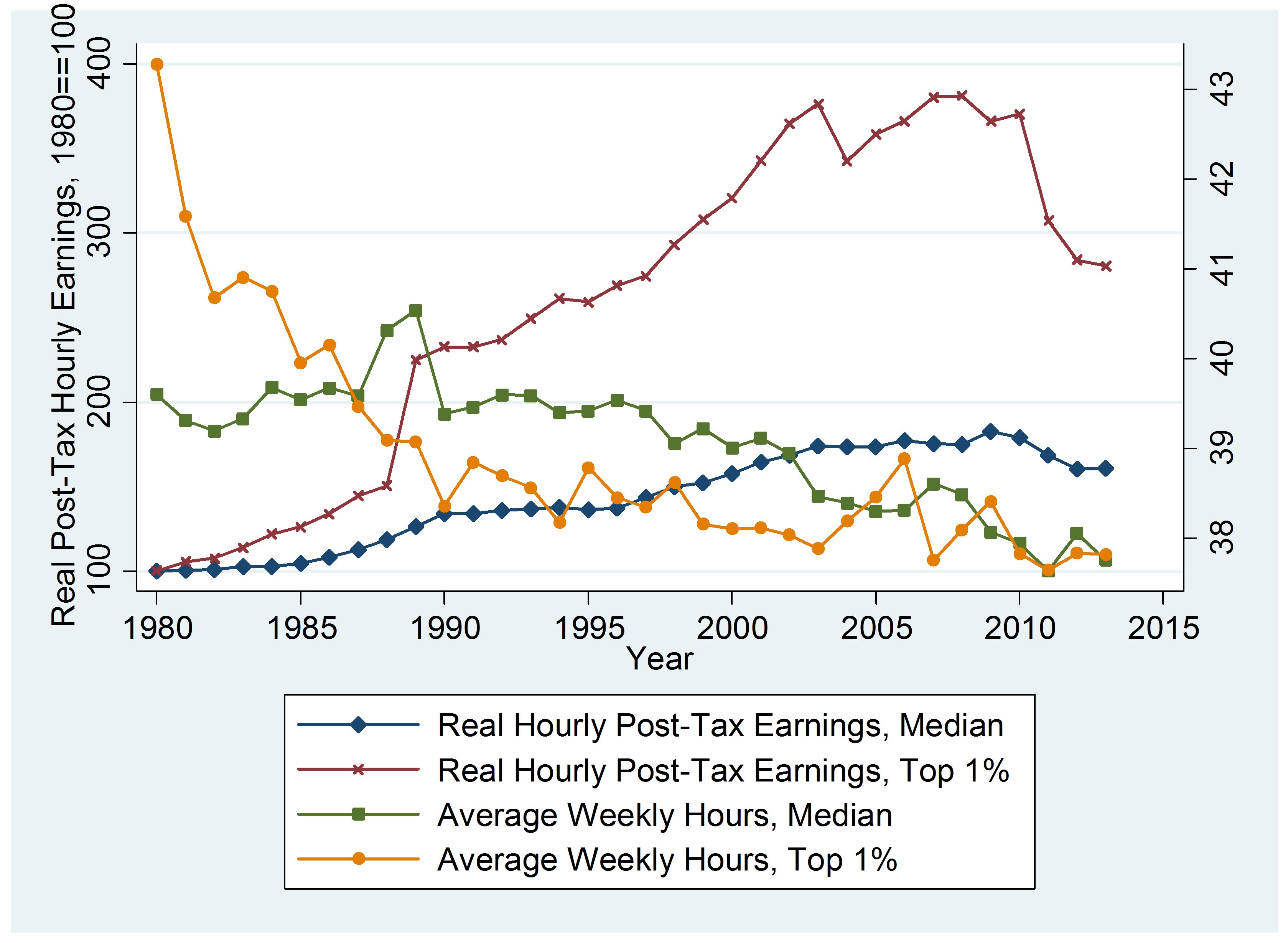

However inequality in the UK has increased since 1980. Overall the average household pays 12000 in tax and receives 5000 in benefits. The original 125 percentage point increase in NI was supposed to raise 12bn a year.

How much money does Scotland contribute to the UK in taxes. Receipts have recovered their pre-recession share of national income and on current policy are set to rise slightly as a share of national income between now and 201920 and then remain relatively flat until the end of the forecast horizon Figure 1. Does the UK have land value tax.

Just under 15 percent of adults now smoke. These studies suggest a range of between 3 and 6 billion costs to the NHS but theres too much uncertainty in the estimates to rely on these bounds or. Other research put it as high as 52 billion in 200506 about 62 billion today.

ONS statistics published in November 2021 reveal the government gained 200 billion in payments to the Exchequer as income taxes PAYE and Self-Assessment and 145 billion in contribution to National Insurance. From 168 billion in 202122 to 6 billion in 202223. The government uses the duty on petrol and diesel to raise revenue and to an extent control the use of cars.

An expected 8 million will be raised from tobacco tax in 202021. The average rate for the higher earner would increase from 51 to 67 if the UK imported the Belgian tax system. The UK raised 35 of national income in tax in 201819.

LVT is a tax on the annual rental value of land in its optimum use. How Much Does Sugar Tax Raise Uk. Tax on share dividends will also be increased by 125 percentage points in a move expected to raise 600m.

This represented a net. Government revenue comes from taxes. Chancellor Rishi Sunak has presented two Budgets already and faces introducing UK tax rises to pay for unprecedented levels of public spending.

By 2025 26 billion people will have access to. In our latest forecast we expect landfill tax to raise 08 billion in 2019-20. The government has received 7 billion for this year and 8 billion for next year.

By comparison LVT at a uniform rate of 005 per cent across England would raise approximately 16bn pa and with the higher rates advocated above total LVT receipts would be much greater. By the end of 202021 the taxes would amount to more than 40 of total revenue of 792 billion. The United Kingdom has 9 million people.

How much does the UK raise in tax compared to other countries. But receive over 5000 in tax credits and benefits. Total tax receipts in 201718 are forecast to be 690 billion.

Thus if the UK increased income tax by 1 of national income approximately 20 billion it would still be a long way below the levels seen in Scandinavia. Where does the UK rank in the world. This is slightly below the average for both the OECD 34 and G7 36 and considerably lower than many other European countries average tax revenue among the EU14 was 39 of GDP in 2019.

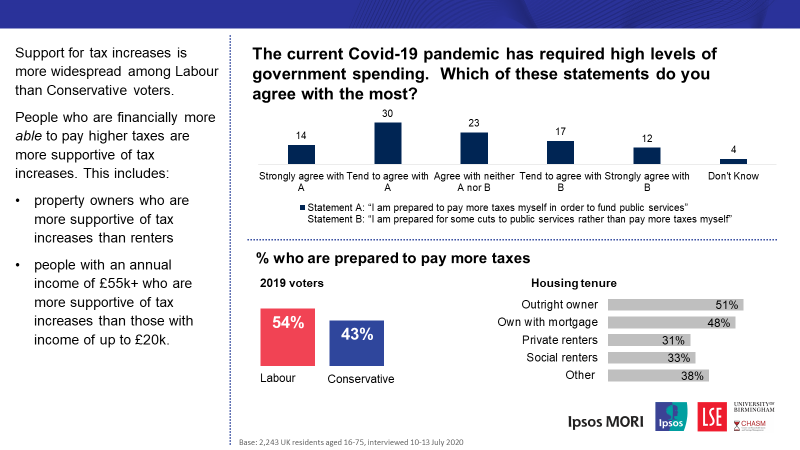

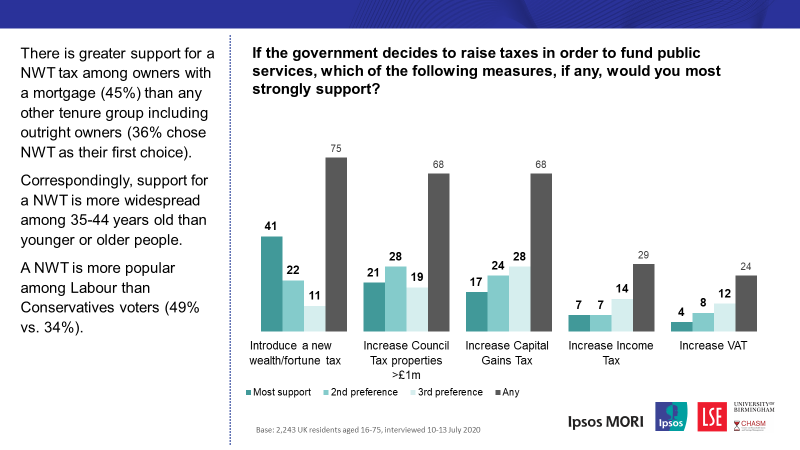

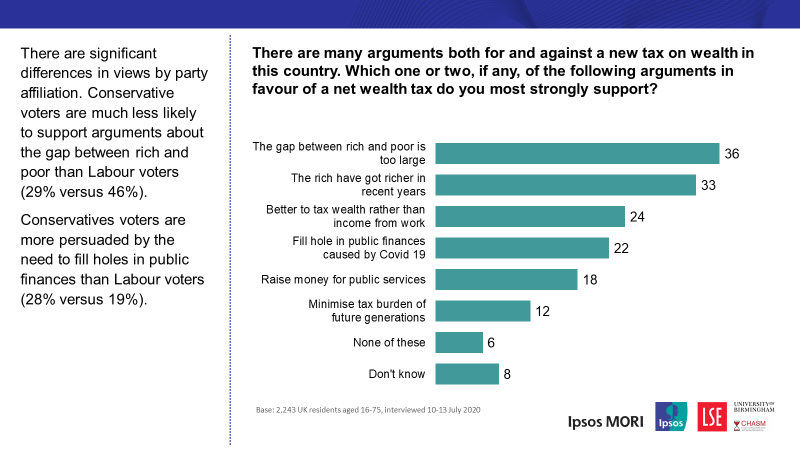

Britons Support Paying More Tax To Fund Public Services Most Popular Being A New Net Wealth Tax Ipsos

Britons Support Paying More Tax To Fund Public Services Most Popular Being A New Net Wealth Tax Ipsos

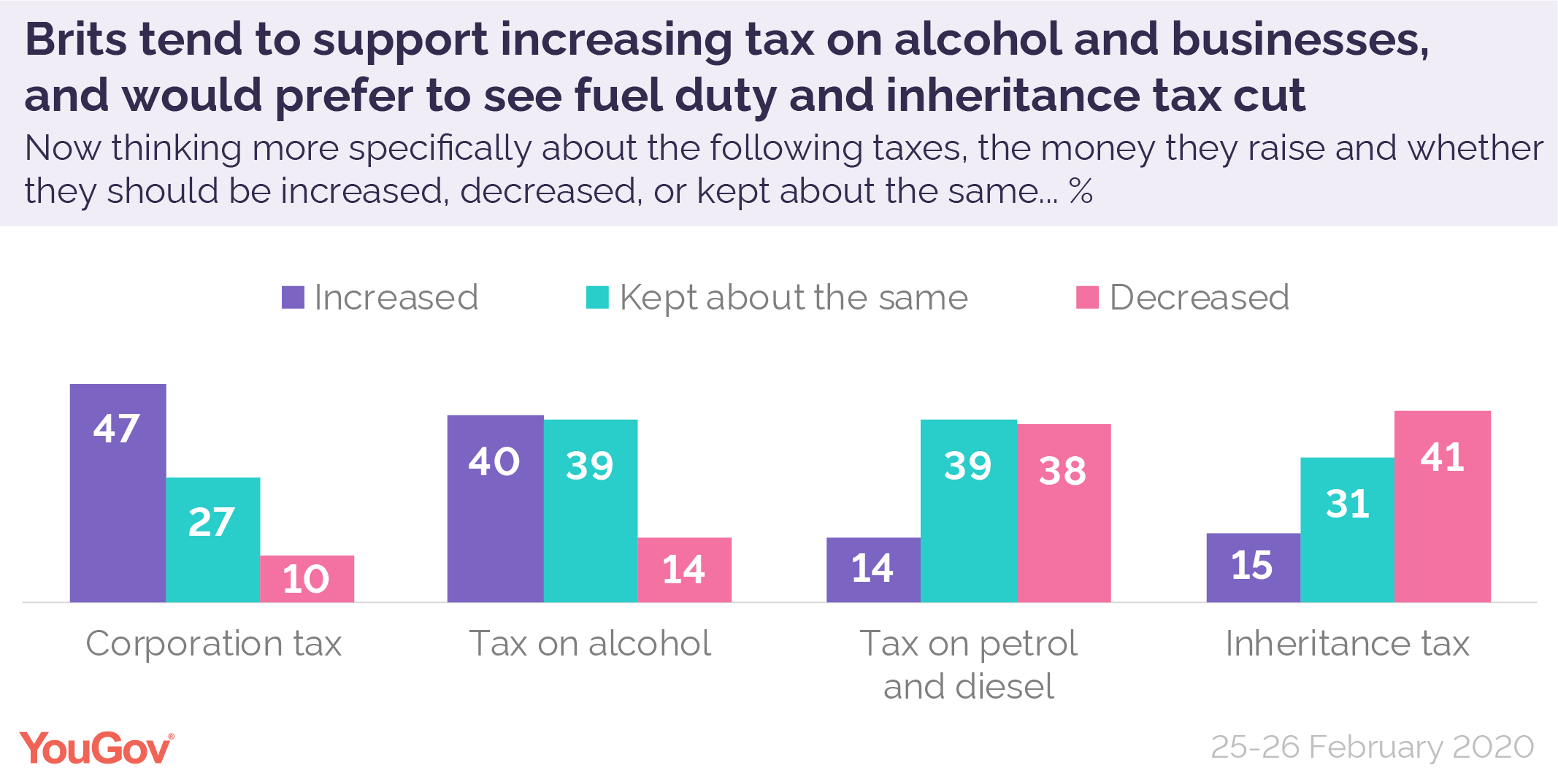

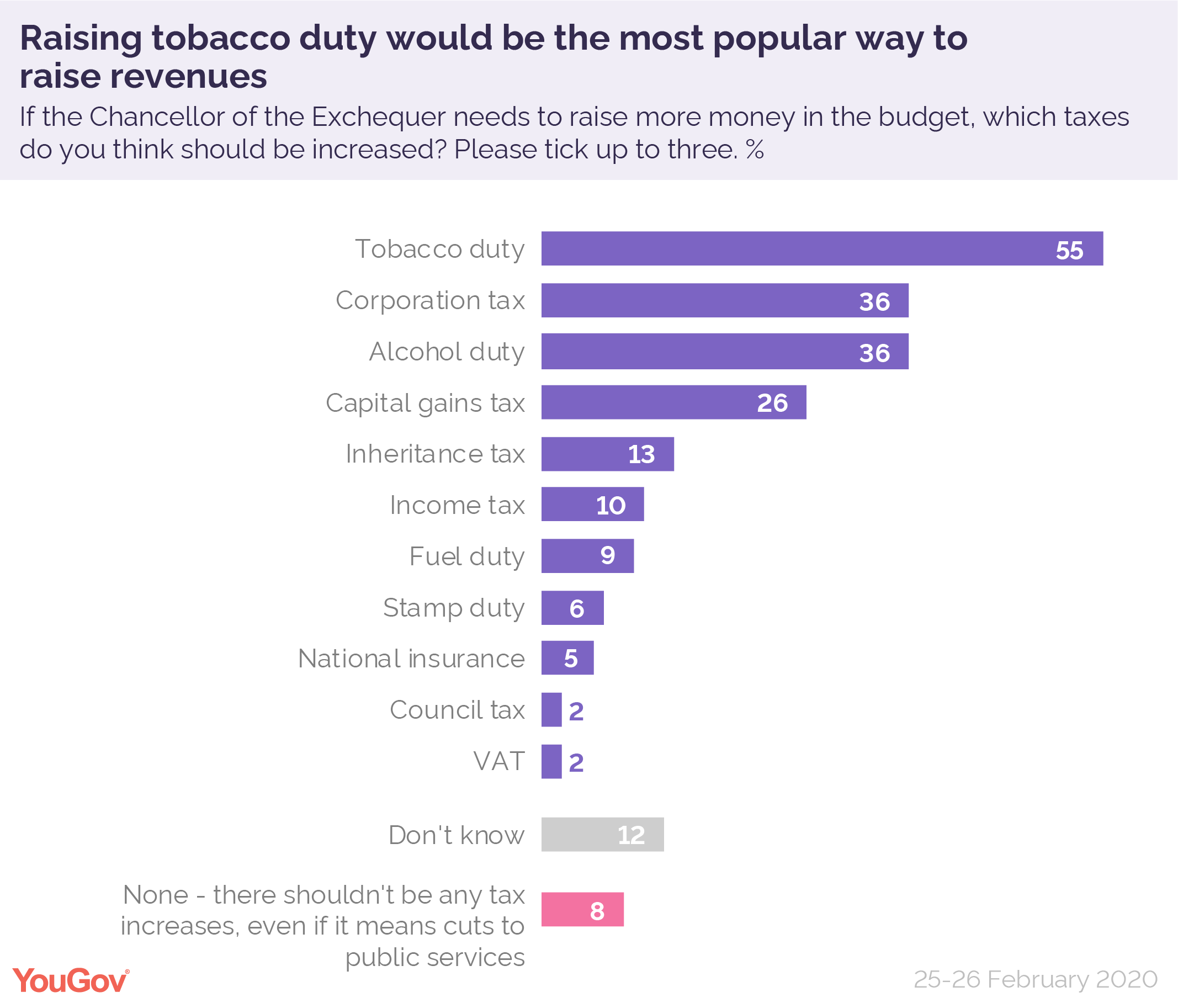

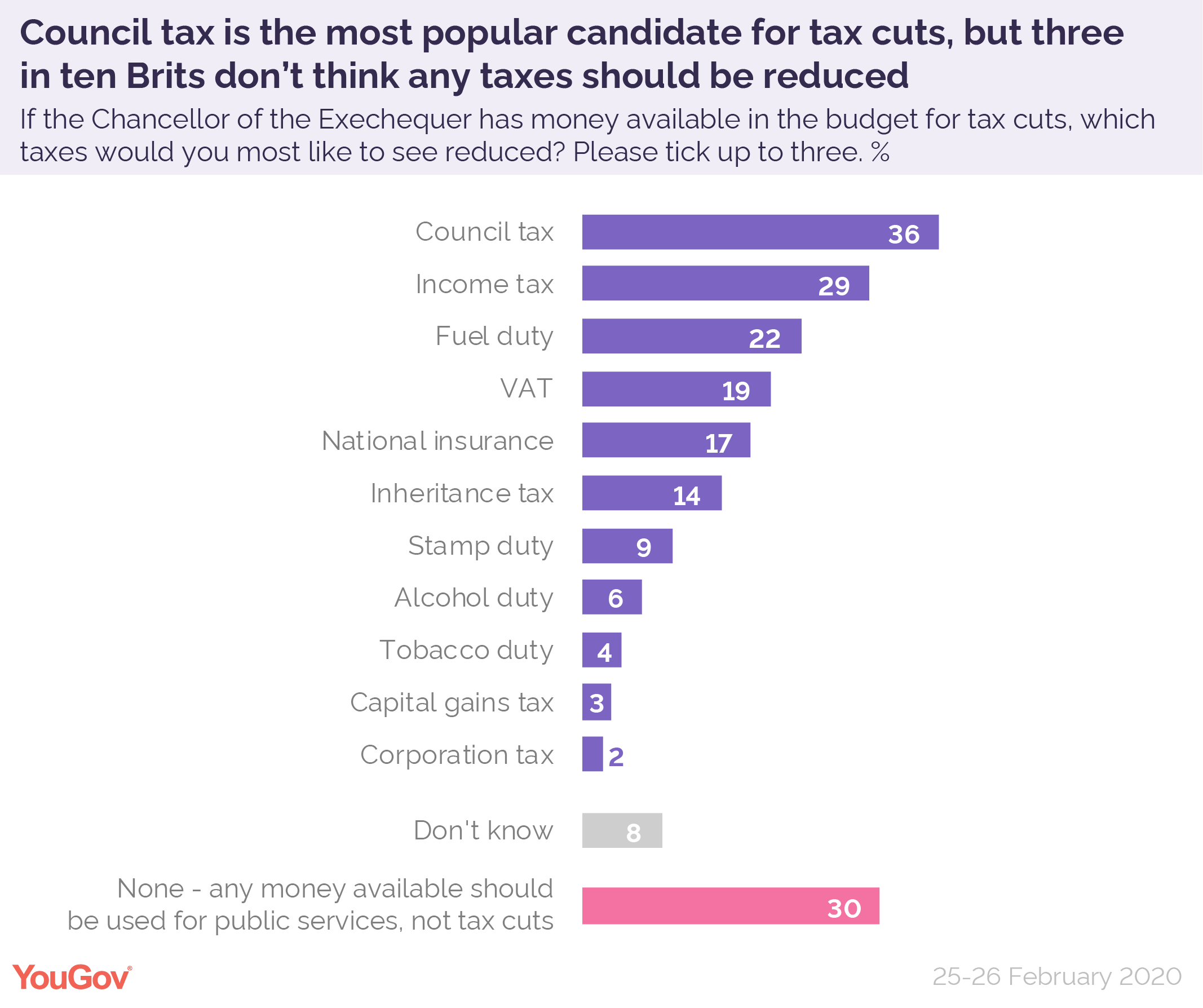

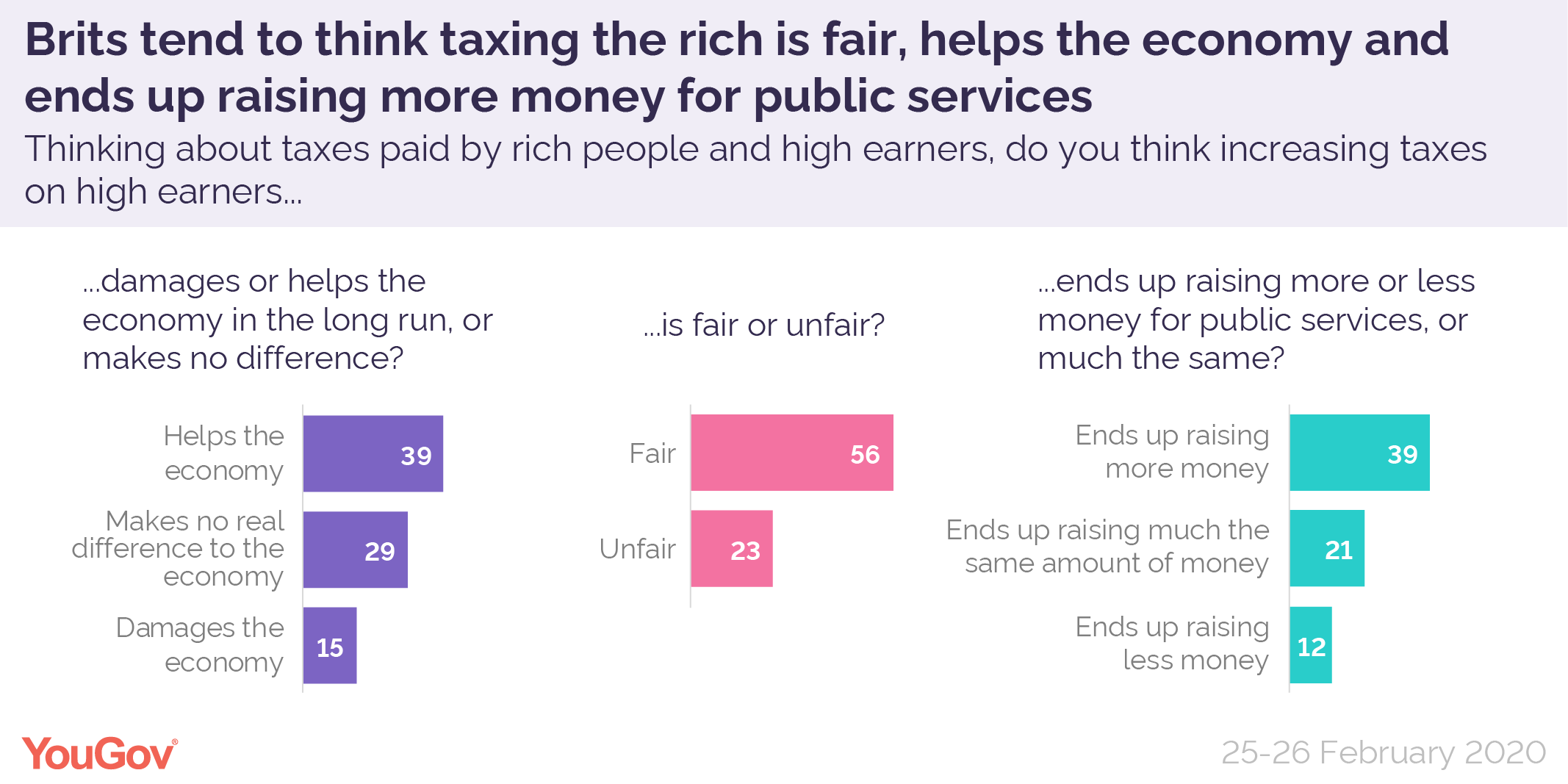

Budget 2020 What Tax Changes Would Be Popular Yougov

Budget 2020 What Tax Changes Would Be Popular Yougov

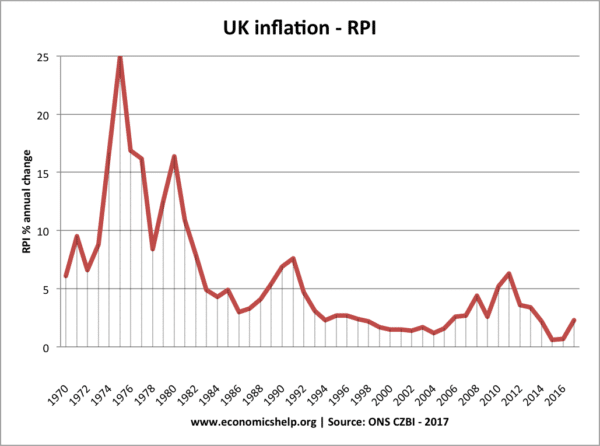

What Is The Difference Between Inflation And Tax Economics Help

Budget 2020 What Tax Changes Would Be Popular Yougov

Boris Johnson And Rishi Sunak Have Announced Tax Rises Worth 2 Of Gdp In Just Two Years The Same As Tony Blair And Gordon Brown Did In Ten Institute For

Boris Johnson And Rishi Sunak Have Announced Tax Rises Worth 2 Of Gdp In Just Two Years The Same As Tony Blair And Gordon Brown Did In Ten Institute For

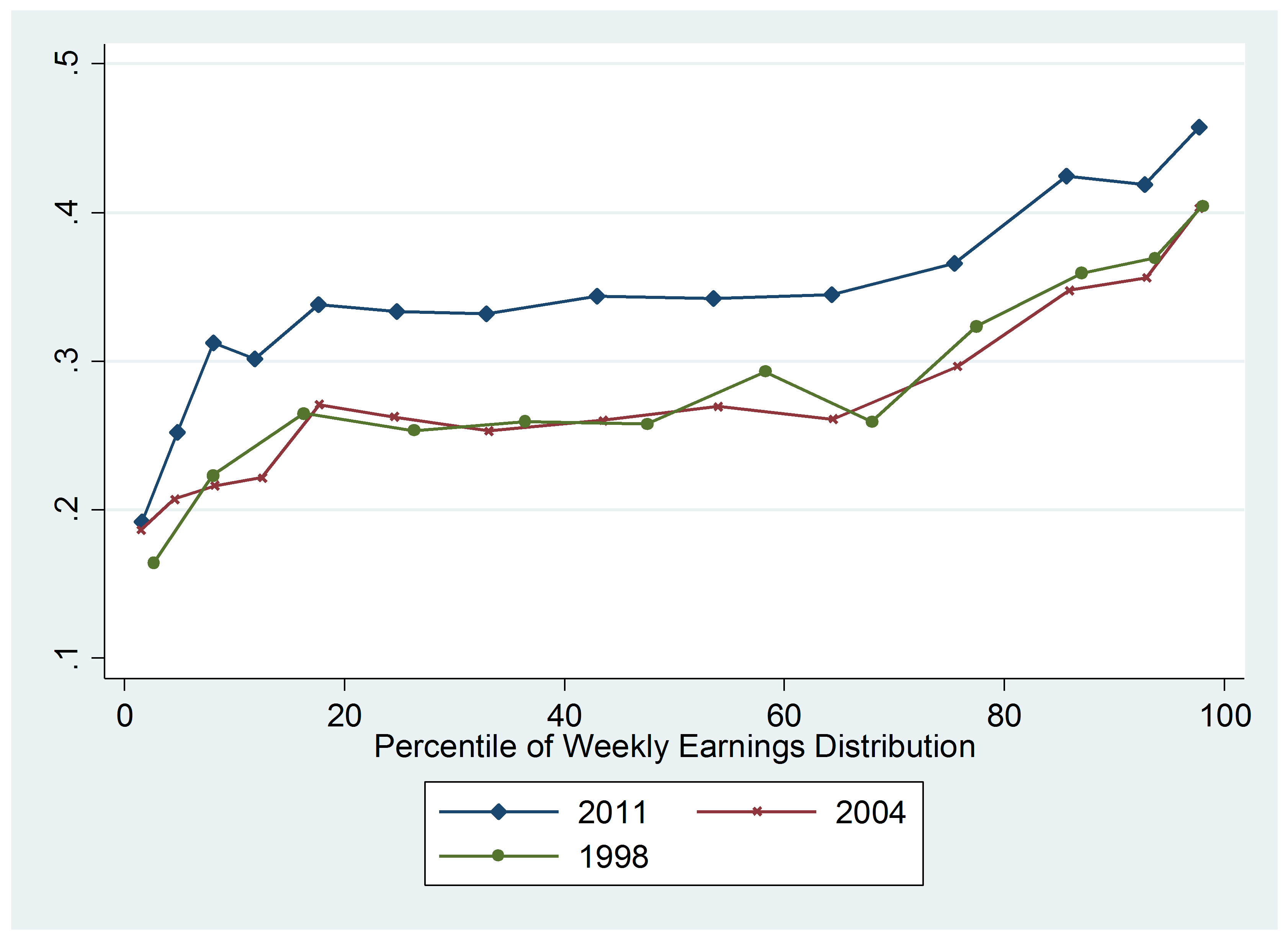

The Top Rate Of Income Tax British Politics And Policy At Lse

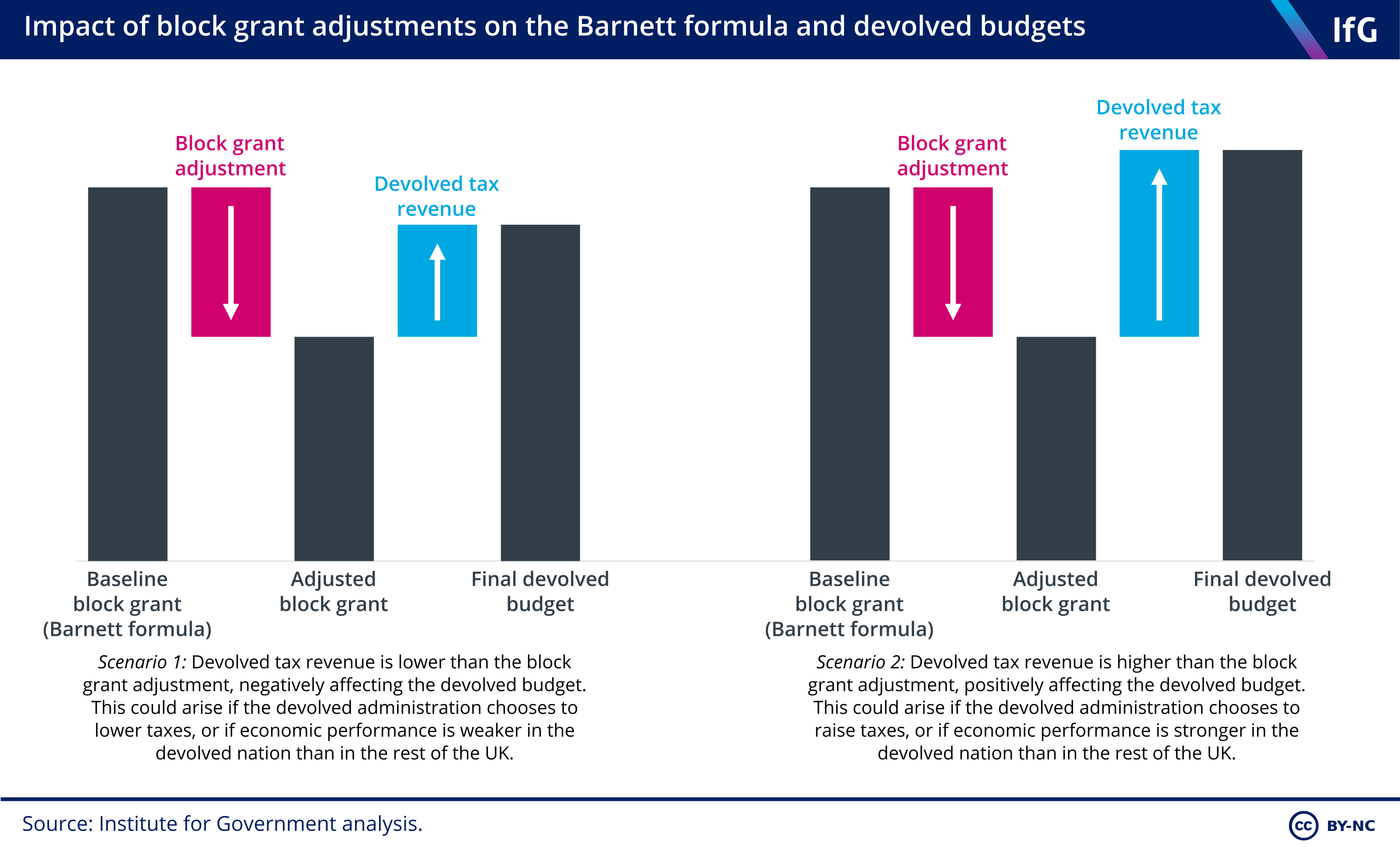

Barnett Formula The Institute For Government

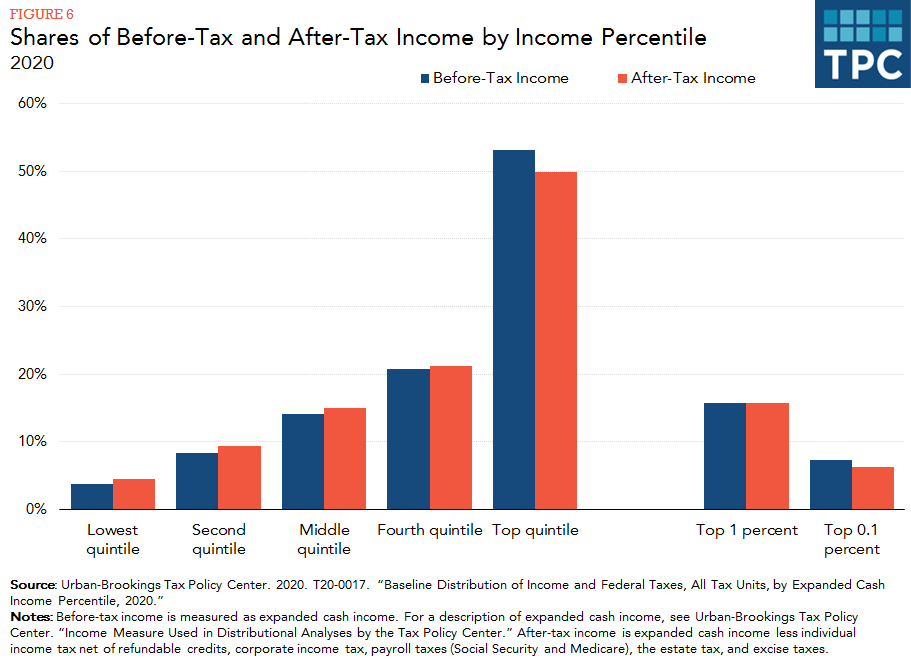

How Do Taxes Affect Income Inequality Tax Policy Center

Types Of Tax In Uk Economics Help

Boris Johnson And Rishi Sunak Have Announced Tax Rises Worth 2 Of Gdp In Just Two Years The Same As Tony Blair And Gordon Brown Did In Ten Institute For

The Top Rate Of Income Tax British Politics And Policy At Lse

Britons Support Paying More Tax To Fund Public Services Most Popular Being A New Net Wealth Tax Ipsos

Budget 2020 What Tax Changes Would Be Popular Yougov

The Top Rate Of Income Tax British Politics And Policy At Lse

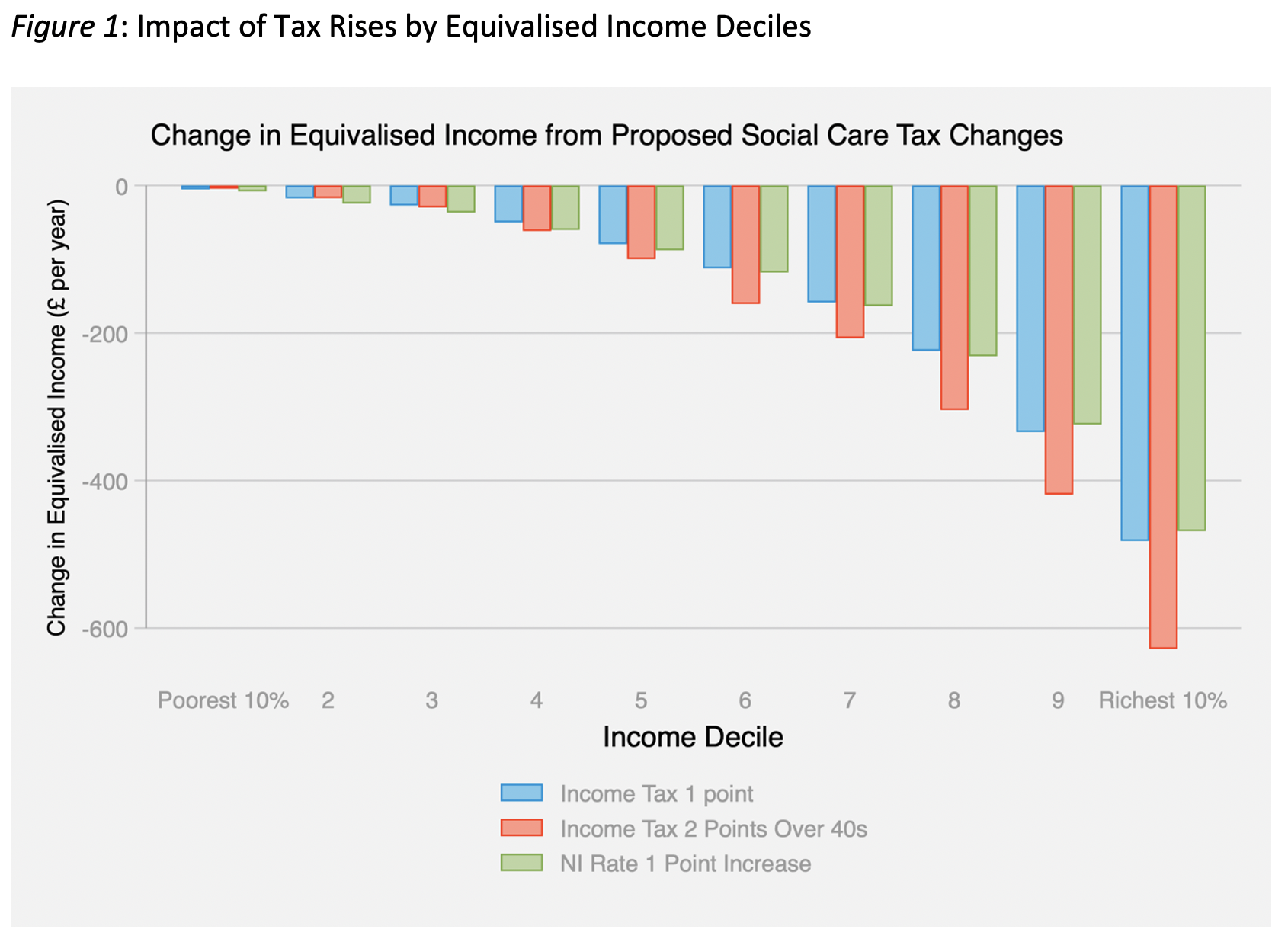

Young People Without Rich Parents Will End Up Paying For A Rise In National Insurance To Fund Social Care British Politics And Policy At Lse