is colorado a non community property state

But there may be certain exceptions to this rule. 1 Answer from Attorneys.

Colorado 2 Withholding Colorado Fort Collins Resident

Below is a List of Spousal States and Community Property States.

. Colorado state law requires an equitable division of marital property. The general rule is that community property is divided 5050. There are nine community property states.

Average per-student funding will go up 6 to 9560. A summary of each of the community property states treatment of property purportedly titled in joint tenancy or tenancy in common is shown in Exhibit 25181-1. That is not to say that if you do not live in a community property state you should not take precautions.

If while in the new state of residence the community property is exchanged for other property the property obtained is usually considered to be community property. Is Colorado a community property state. Jared Polis last week.

In these states all property of a married person is classified as. Colorado is not a community property state. Joint Ownership of LLC by a Spouse in a Non-Community Property States.

Lawmakers are also putting 80 million more into special education getting closer to. Colorado is not a community property state in a divorce. Colorado is not a community property state but it does have a category called marital property.

Is Colorado a community property state. The short answer is no Colorado is not a community property state. Any property owned by either spouse before the marriage is considered separate property and any property acquired after the marriage is usually going to be marital property unless it can be shown to fall into an exception to.

10 hours agoDemocrats say theyre proud of the 364 billion budget signed by Gov. Yes- Both husband and wife must execute deed of trust which is to encumber property of the community. Colorado is not a community property state but it does have a category called marital property In Colorado most assets acquired during a marriage are considered marital property which is subject to division by the courts in a divorce.

Is Colorado a community property state. Instead of dividing property 5050 in a divorce case the Colorado courts will divide marital property assets and debts in a way that is. In Colorado most assets acquired during a marriage are considered marital property which is subject to division by the courts in a divorce.

Peter and Jane jointly. Colorado court usually assumes that each spouse contributed to the marriage and the property and thus an equal division of marital property is fair. The budget dedicates more than 5 billion in state money to base K-12 spending a 75 increase over this year.

Is Colorado is a community property state. Those states are Alaska South Dakota and Tennessee. Colorado is an equitable distribution divorce state.

Non-Community Property States. Alaska Arizona California Idaho Louisiana Nevada New Mexico Texas Washington and. The courts ability to divide marital property if a couple divorces does not impact a spouses ability to give away his share of.

However Colorado is not a community property state. However in community property states you can have your multi-member husband and wife owners and that LLC can get treated as a SMLLC for tax purposes. Courts have much more leeway to determine how property is divided in equitable distribution states The majority of community property states wont deviate from the 5050 division regardless of the circumstances.

Despite the risk of having unpaid debts in a community property state the reality is the great majority of states are common law states. That means marital property isnt automatically assumed to be owned by both parties and therefore should be divided equally upon divorce. All three states also allow couples to establish a special trust to hold assets that are treated as community property.

In separate property states only the part of the property which was owned by the deceasing spouse gets step-up in basis. Instead when a couple divorces in Colorado the marital property is divided in an equitable manner. However non-owner spouse should execute a disclaimer of interest in the property Quitclaim Deed Interspousal Transfer Deed etc No.

If an LLC is owned by a husband and wife in a non-community property state the LLC should file as a partnership. The division of property is one of the main issues during a divorce case in Colorado. Colorado is NOT a community property state which means that marital property is not automatically divided 5050 between the spouses in.

Other community property states recognize these forms of ownership and will treat the asset as separate property of the spouses held in joint tenancy. Community property retains its characterization when the couple moves from the community property state to a Non-community property state. People often ask.

Colorado is an equitable distribution state which means property will be divided by the court in a manner that is deemed fair to both parties but not necessarily equal if spouses cannot come to a resolution on their own. Instead Colorado courts divide the property of divorcing couples using a method called equitable distribution But what does that mean. It uses a common law doctrine rather than one based on the laws of community property.

From an income tax perspective community property has a significant tax advantage ie. This means that your spouse is not responsible for your unpaid debts. Colorado is an equitable distribution or common law state rather than a community property state.

Rather property is divided on an equitable basis. The nine states that DO have a community. Arizona California Idaho Louisiana Nevada New Mexico Texas Washington and Wisconsin.

Does it mean equally 5050. The rules vary greatly on this. In the United States there are ten community property states.

If record title to real property is held as a spouses sole and separate property signature of non-owner spouse is not required. In equitable distribution states more assets may be considered marital property but the split is not necessarily 50-50. Upon the death of the first spouse the entire property regardless of legal ownership gets step-up in basis.

In each state you and your spouse have to create a community property agreement specifying which assets or debts should be considered equally shared. Colorado is also a dual-property state which means property can be defined as either marital or.

Steve Albright Builder Llc Was Formed On 2007 02 13 In Colorado By N Steve Albright Located At 2540 Middle Creek Road 705 S Creede Creede Colorado Colorado

How Is Property Divided In A Colorado Divorce

Filing Colorado State Tax Returns Things To Know Credit Karma Tax

The Most And Least Favorite Us State Of Each State Mapped Vivid Maps Funny Maps Map North America Map

Colorado Inheritance Laws What You Should Know Smartasset

The Procedures For A Colorado Annulment Are The Same As Those Those For A Divorce Or Legal Separation With Two Legal Separation Divorce Mediation Divorce Help

Electric Utilities Colorado Energy Office

Colorado State Taxes 2022 Tax Season Forbes Advisor

Colorado Gun Laws Colorado State Patrol Csp

National Colorado Day April 12 National Day Calendar

Latest News Colorado State University System

Darwin Horan Real Estate Business Denver Activities Darwin

Is Colorado A Community Property State Cordell Cordell

Colorado State Veteran Benefits Military Com

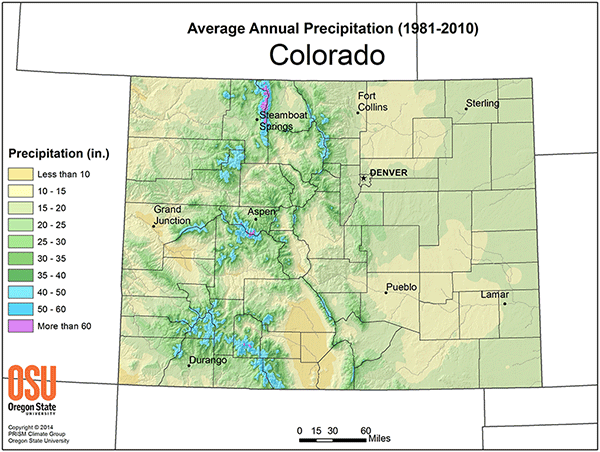

Climate Colorado Water Knowledge Colorado State University

What Is Common Law Marriage In Colorado Cls

Pin On Colorado S National State Register Listings

Entrance To Gold Mine Gold Mining Cripple Creek Mining Company